Greg Wyler is the founder and executive chairman of OneWeb, which filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Southern District of New York on Friday, March 27. Following the bankruptcy filing, Wyler did an interview with Via Satellite Editorial Director Mark Holmes about the future of low earth orbit (LEO) satellites.

It is mid-April and late on a Sunday night. I am just about to go to bed, and I do that foolish thing that many of us do and check my work email one last time. I see an email from Greg Wyler asking if I am free. Of course, I can't turn down this opportunity, so I head to my outside office to talk to Wyler about the bankruptcy announcement.

One of Wyler's goals in life has been to connect the unconnected, and it's hard to believe that he will give up on this mission. However, with O3b now part of SES, OneWeb unlikely to see the light of day, it remains to be seen what is next for Wyler, who has been one of the most talked about individuals in our industry. It is also hard to believe we have heard the last from him.

So, I come straight to the point, and ask if the marriage between Wyler and the satellite industry is over, even if the mission to connect the unconnected is still not. Wyler admits he has a "lot of pent-up ideas" but refuses to say whether the industry has seen the last of him.

"I wouldn't say I am out of satellite. I still believe satellite could play a very big role for a lot of use cases. The consumer residential use case, for instance, and I will speak in terms of homes per square kilometer, anything over 25 homes per square kilometer or higher, this is probably not a good use for satellite. So, you are really moving to rural and remote. The demand case for consumer broadband, far outstrips the ability of any satellite system to deliver competitive quality in volume, no matter how many satellites you put up," he says.

He admits he gets interesting opportunities across the space domain at least weekly, if not every other day. "I would not make a definite statement related to my space-based activities. Time will tell," he says.

Wyler, despite recent events, seems in good spirits. He has a restless energy, which I doubt will ever change. I ask, when he looks back at the OneWeb/O3b experience, what is the one thing he would change. He says, "I think LEO satellites have a long way to go. They are still in their infancy in terms of design and technology. They are still fat, heavy, and have very limited throughput. Even though they look like they are supercharged compared to ten years ago, they are still pretty darned inefficient vehicles for communications. There is a lot of opportunity for improvement in the future, so I wouldn't write off satellites. But, certainly for the next 10 years because for one, there are serious capacity density issues where satellites cannot provide the capacity density to compete with the likes of Comcast. Just the bandwidth of Comcast in the U.S. in a big town or what VirginMedia would put down in parts of London could consume 20 LEO satellites for just one small area – which is impossible to because of spectrum co-channel interference issues. Another major problem for satellite in consumer broadband is the constantly growing uplink speed requirements of consumers."

He seems in reflective mood when looking at the potential value of LEO systems. He adds, "There are a lot of really good LEO business models and applications. While there aren't any LEO plans that could justify growing into a $100 billion valuation, there is room to create some really valuable businesses. LEO systems have three issues to balance: The massive cash requirement, the real, and not imagined, revenue generation capability, and the third is time. These things slip in time to the right which increases costs and often decreases revenue generation capability as the world changes around them. For instance, there isn't a system today which is more cost effective than terrestrial systems except for the physical availability issue – being remote – or on the move."

When you hear Wyler talk about the OneWeb and the O3b experience, you understand that building that this type of business is such an unbelievable challenge, the odds are long, and that it is not hard to wonder why so many of them fail. It seems the odds are stacked against them right from the start. He admits that O3b was constantly on the edge of Chapter 11.

"It is not clear that the value that is created is worth the infinite dollars that are being put in [to these systems]. From a business sense, where you have to raise money with the expectation of returns you normally have to take investment at price that allows for a strong return. In terms of pure capital, these things are really, really difficult, not because they can't make money, but because the capital required is so high it rapidly reduces the pool of potential investors that can get involved," he says.

"When you are working with investors, and $25 million is the minimum investor size, and then it goes to $100-150 million of single bet risk allocated capital, that is a small pool of potential investors. With O3b, there were so many times when we said, how do we make payroll? how do we make payroll and still build things? You are spending $50 million to $100 million a month. These are massive numbers. If there is any slip-up in the investment stream, it is very easy for whole company to stumble. That is frankly what happened here, there was a slip-up in the investment. It may emerge much stronger than when it went in. That can happen in Chapter 11. The future is yet to be written."

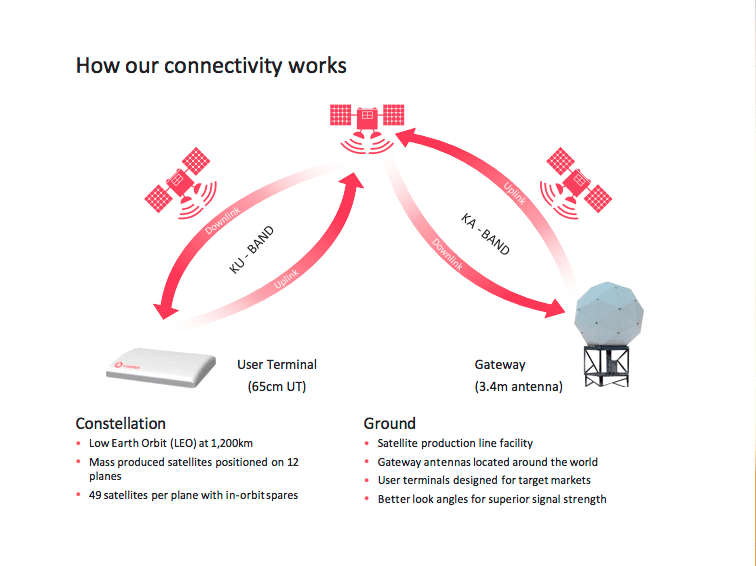

An overview of how OneWeb's low earth orbit network was envisioned as working in its end state. Photo: OneWeb

I continue to probe this question. I ask bluntly knowing what he knows now, would Wyler have even put together OneWeb, and he goes as far to call large-scale consumer broadband "dead on arrival" for satellite.

"I would have done things differently," Wyler said. "Technology has changed dramatically. Everyone is still on the 2012 OneWeb plan. It has taken nine years to turn that into a physical embodiment. The world has changed a lot. I still think OneWeb had and has tremendous value. A number of business plans were developed [for OneWeb] and a number of them have great value. But, the large-scale consumer broadband market is dead on arrival for satellite. It is niche at best."

It seems business plans built on technology that takes years to build are fraught with risk. "The world changes around you. This is what happened to Iridium and Globalstar. They had great business plans except the world changed around them. So, what is happening right now for LEO constellations? For anyone focused on consumer broadband, the world is changing beneath their feet. Terrestrial is making massive leaps in terms of technology and speed of adoption. So, if you are going to spend $5 billion to do consumer broadband, you can build a whole lot more terrestrial at higher capacities."

One of the interesting dynamics of this whole story as the relationship between Wyler and Softbank. Understandably, Wyler does not want to talk in depth about this, although one can obviously sense his disappointment that they pulled the plug when they did. At one point, Softbank was all in on OneWeb, and then ultimately it lost faith. Wyler points out that it wasn't just OneWeb, but other investments Softbank pulled back from, but diplomatically does not say more than that. But I sensed an overall disappointment in how this played out.

Failure is a Part of Risk

OneWeb's fall into Chapter 11 made headlines even beyond the space industry, and was covered across the media landscape. Similar to SpaceX, the interest in OneWeb and Wyler's "mission" transcended beyond the space industry. Some within the industry have been outspoken about OneWeb, and the belief that its business plan was fundamentally flawed.

I ask Wyler if we can classify OneWeb as a failure. He says using such a term would be "too harsh." He adds, "But, for a global disaster, it would still be around. It has been in trouble. These type of companies live on the edge of trouble. What startup can spend $100 million a month and not be on the edge? If you are doing something difficult, going into unchartered waters, you are typically in a high-risk environment."

He makes a comparison with Charles Lindbergh who did the first solo transatlantic flight and made history back in 1927. Wyler makes an interesting analogy. He says, "People said to Lindbergh, you are probably going to fail, you will never make it across the ocean, and they were statistically correct, but it doesn't mean he shouldn't try or advance technology or accomplish a goal in a way that sets expectations higher than normal. It is a pretty weak thing to do to criticize him and say it is unlikely he will make it. One of the problems you have is that there are a lot of people who have economic interests who are completely misaligned with the company, i.e., they want to compete. It is easy for a lot of people who feel a competitive threat to throw stones. But, they are not meaningful stones. Everyone who said it would fail, they are maybe right. But, that is what being a risk taker is about. Just saying something challenging will fail without deep technical/market understanding is a funny pot shot."

|

Want to hear more on aircraft connectivity applications? Check out the Global Connected Aircraft Podcast, where Avionics editor-in-chief Woodrow Bellamy III interviews airlines and industry influencers on how they're applying connectivity solutions. |

I put it to Wyler that essentially, OneWeb is the first major space casualty of the COVID-19 era. He thinks about it for a second and says that is one way you could put it. But, he remains optimistic for the future. His mission, it seems, is not yet done. "You have a continuing global disaster. So, with the world crumbling, that is going to put pressure on projects with high capital requirements. Very few companies are getting funded. The company I am involved in, Tarana Wireless, just closed another round, but that was rare. The reason I am involved, is I think they have absolutely the world's best technology to bridge the digital divide from the terrestrial perspective. That technology is just so off the charts good."

Despite its troubles, and some believing OneWeb will leave a less than positive legacy, Wyler believes there will be a lasting impact of the work OneWeb did.

He says, "I was told at a space conference with hundreds of New Space startups, that OneWeb's high profile and high funding made a number of people recognize the value and potential of space. OneWeb put billions of dollars into companies to develop space hardware. That was a major boost for the space industry. Thinking of this experience as just about OneWeb would be short-sighted, rather, its better to think of the industry and more importantly the benefit to humanity from the very public focus on the need for broadband to help lift the world's poorest populations out of poverty. Of course, not everything on the journey went as planned, but that is just the way it is sometimes."

Editorial Note: This article was originally published in Via Satellite, a sister publication to Avionics. It has been edited. To view the full version, click here.