Valour Consultancy recently released the Q1 2020 update associated with its quarterly in-flight connectivity (IFC) tracker, which shows an uptick in the number of aircraft added to the global connected fleet. (Airbus)

Valour Consultancy recently released the Q1 2020 update associated with its quarterly in-flight connectivity (IFC) tracker, which shows an uptick in the number of aircraft added to the global connected fleet; a positive headline in the context of what is known today.

The following bullet points summarize noteworthy headlines:

- An estimated 140 aircraft were added to the active installed base between January 1 and March 31.

- Gogo and Viasat, together, contributed over two thirds of installations in the quarter, with Panasonic Avionics and Inmarsat also making notable gains.

- Air France is in the process of quickly deploying Gogo's 2Ku and Global Eagle's Ku-band IFC service on its long-haul and short-haul fleets, respectively, and is estimated to have connected 34 aircraft in Q1.

- 106 airlines had a commercially active IFC service installed on at least one aircraft during the quarter.

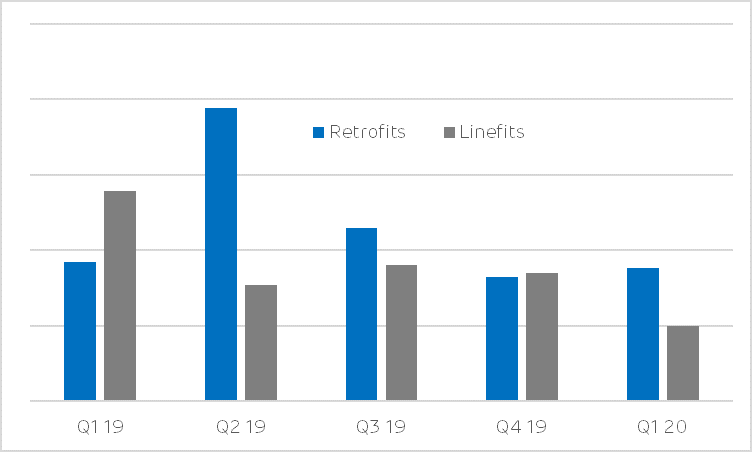

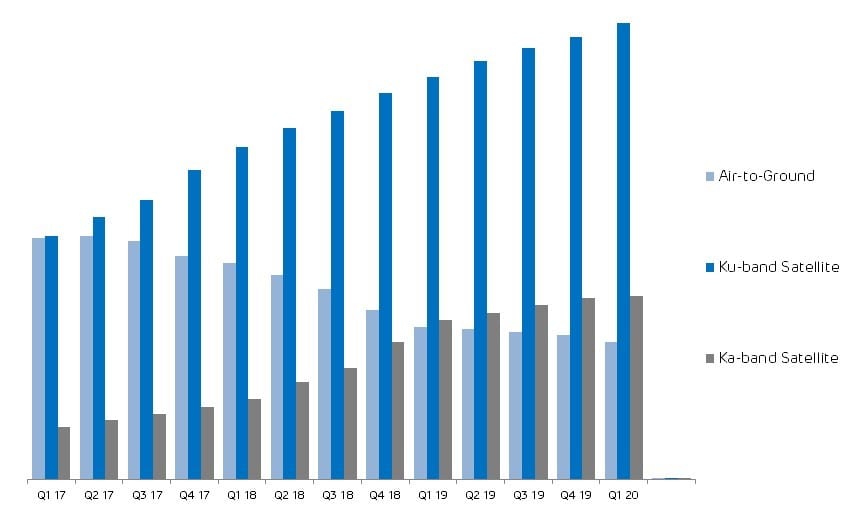

Valour's data also shows retrofit installations increased slightly year-over-year (see chart below). However, it is here where the positives end and the early indicators of what's to come in the remainder of 2020 begin to appear. The same chart also highlights that the number of new aircraft delivered to airlines with IFC installed at the factory fell to levels not seen since Q1 2017, aligning with a slowdown in aircraft production caused by shutdowns at global manufacturing hubs. A notable factor was the mid-March closure of key Airbus production and assembly lines in Spain and France, with both countries badly affected by COVID-19.

By the beginning of April, airlines around the world had already begun to make decisions to align fleets with a reduced demand that looks set to remain for years to come, leading to older and less fuel efficient aircraft types being sent into early retirement and the deferral of new aircraft deliveries. To date, fleet reductions have been most significant in North America, with Delta Air Lines retiring B777, MD-80 and MD-90 aircraft, American Airlines bringing forward the retirement of close to 100 aircraft and Air Canada culling 80 aircraft across its mainline and Rouge operations.

Inevitably, some of the aircraft heading for an early retirement are equipped with IFC hardware. With such a large proportion of aircraft retirements so far coming out of North America, it won't surprise the reader to learn Gogo is projected to be the service provider most affected by these cuts. Valour Consultancy estimates the company's North American installed base will reduce by a little over 200 aircraft in Q2 2020 and the number of commercial aircraft active on Gogo's ATG network could fall below 1400.

Gogo certainly isn't alone here. In Europe, Lufthansa Group and Norwegian Air Shuttle also announced sizeable cuts which look set to reduce the active installed base of Panasonic Avionics, Global Eagle and Inmarsat connectivity solutions. Inmarsat will also be keeping a close eye on the status of Avianca, which was in the early stages of deploying GX connectivity on 90 aircraft before filing for Chapter 11 bankruptcy in May 2020.

Avianca is one of a relatively small group of airlines currently going through a financial restructuring process. The threat posed by further bankruptcies must be considered a longer-term problem for both the industry and the global IFC installed base – a threat which won't be fully understood until government aid around the world begins to fall away in the latter stages of 2020.

Importantly, most airlines that have already deployed IFC have shown no intention to remove it from aircraft that will take to the skies again at some stage, but with so many connected aircraft grounded –in some cases for the long term – the focal point looking ahead will be the how far service revenue generated per aircraft falls. IFC contracts are complex beasts that tend to go beyond just the provision of IFC airtime and can link to hardware, content and other elements, so it is unlikely we will see cases where payments between an airline and its service providers simply fall to zero.

A decline in revenue is inevitable, though, with global passenger numbers down and airlines making sizeable cuts to non-essential spend. Without airtime fees, we should see quarterly connectivity revenue fall close to a level representing the minimum value of IFC contracts.

The Q1 2020 data from Valour's IFC quarterly tracker has provided a glimpse into what we can expect to see in Q2 and beyond. Valour will publish the next update in July 2020.