Multiple disparate trends could forcefully reshape power systems around the world. As electricity markets transform, technologies advance, industries converge, consumption patterns change, environmental concerns increase, and "prosumers" emerge, power companies must innovate and evolve to deal with the disruptions.

In a recent lecture at Rice University in Houston, distinguished macroeconomist and economic historian at Northwestern University Robert J. Gordon presented an interesting scenario: If a person fell asleep in 1870 and awoke in 1939, he or she would barely recognize a world revolutionized by five great inventions–electricity, urban sanitation, chemicals and pharmaceuticals, the internal combustion engine, and modern communication. Gordon, who lays out his argument in a book, The Rise and Fall of American Growth, posited that this pivotal period was followed by another lengthy set of decades in which those inventions were refined and exploited.

But since the 1970s, only a faint wave of change has saturated culture, he said. Our modern world–characterized by technological stagnation, rising inequality, and plateauing education levels–will never again see as great a transformation. Not even by computers and digitalization, which have so far only affected a small section of the economy, he argued, mostly in entertainment, information, and communication.

As powerful as they are, Gordon's economically weighted theories–which rely on total-factor productivity, an economic measure based on gross domestic product of efficiency due to innovation–are short-sighted, some industry heavyweights have contended. Among them is Microsoft founder Bill Gates, who opined in a blog post that the "digital revolution affects the very mechanism of the marketplace." Many others point out that it's a change flipping many of the world's industries on their heads, the power sector prominent among them.

Electricity Markets: A Disruptive Vehicle

The power sector's transformation over the last 10 years has been profound and unmistakable, even if uneven across power's diverse landscape. But digitization isn't the only factor disrupting it.

According to Prajit Ghosh, the global content and commercial strategy head of Wood Mackenzie's Power and Renewable's division, underlying this transformation are electricity markets, which he argues have been as immense a "catalyst" of change as smartphones have been to modern living.

Since selected regions around the world began restructuring their traditional, vertically integrated utilities in the early 1990s by introducing competition among large-scale generators, power markets have absorbed–albeit at varying rates and scopes–new drivers of change. Among them are technological drivers such as utility-scale wind and solar, distributed generation, smart grids, energy storage, and energy efficiency. Incentives, business models, and institutional approaches have further vastly leveraged changes, posing challenges to traditional grid planning and operational practices as well as business models both for utilities and other power companies.

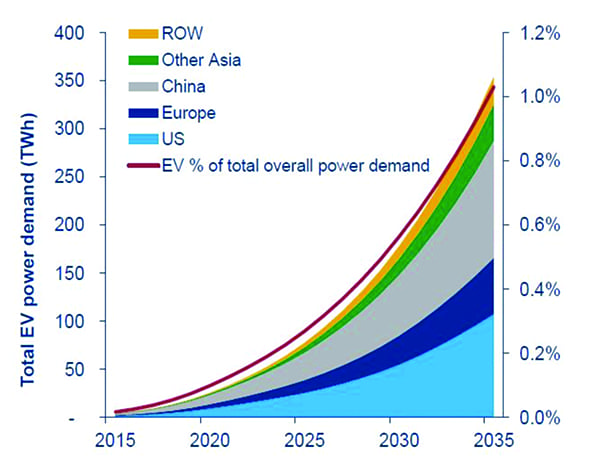

"Arguably, electricity markets will serve the same purpose as smartphones did," Ghosh said in October. "And the simple reason is that electricity markets are not a primary commodity–not a combustible fuel like coal or natural gas. They are really a clearinghouse for multiple commodities, whether for coal, or natural gas, or renewables, or nuclear, or biomass." Power markets are also creating links between unrelated energy markets. For example, while most countries don't use a significant amount of oil for power generation anymore, transport electrification and electric cars (see sidebar, "The Case for Electric Vehicles") have enabled that link, Ghosh said.

Rapid Technological Advances

Another key marker of disruption, according to Ghosh, is the rapid–"rapid being the code word here"–advancement of technology. Since 2007, the cost of wind and solar power has fallen dramatically as capacity factors have soared, contributing to their quick uptake across all markets, including as offshore and distributed sources, he said.

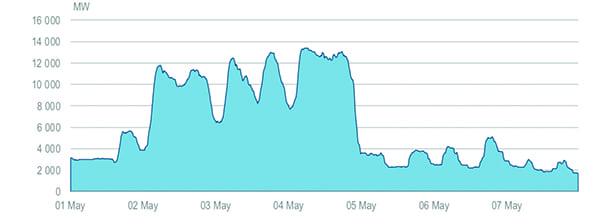

According to the International Energy Agency (IEA), variable renewable energy penetration is approaching a 20% to 30% share in many markets, and the wider industry is already seeing repercussions. In Germany, for example, conventional thermal plants–and particularly coal plants–have adopted equipment, software, and operational modifications to be more flexible in order to achieve higher ramp rates, more starts and stops, and much lower minimum generation (Figure 2).

|

| 2. Generation of hard coal in Germany. The increased share of variable generation in Germany has posed technical and economical issues for thermal generators, but they appear to have adapted. This graph, showing the generation pattern of the country's hard coal power plants over a seven-day period in 2016, demonstrates their ability to cycle. Courtesy: ENTSO-E (2017a), Actual Generation per Production Type |

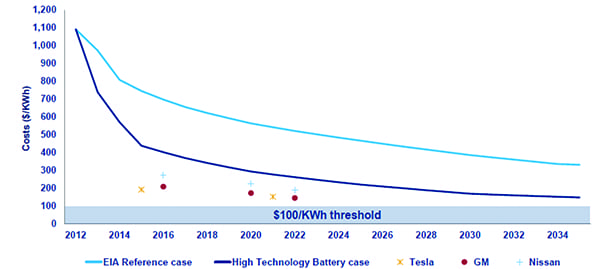

Energy storage, too, has made major gains. Considered for years as a "holy grail" that could transform intermittent forms of energy production into firm, baseload capacity, energy storage developments garnered serious notice by the power sector sometime between 2011 and 2014, a period during which a number of demonstration projects showed various technologies could optimize energy delivery. (For more, see "Battery Storage Goes Mainstream" in POWER's May 2017 issue.) According to market research firm IHS Markit, the global energy storage market installed 6 GW in 2017–an exponential increase from the 0.34 GW installed in 2012 and 2013. Experts widely project that this growth will continue, owing to tumbling battery storage costs (Figure 3). IHS's forecasts show that annual installations could surge to 40 GW by 2022.

|

| 3. Falling battery pack cost projections. According to Wood Mackenzie, costs predicted in 2012 for 2030 have already been achieved. Falling costs will have long-term implications for renewables and transport electrification, it says. Courtesy: Wood Mackenzie |

Another reason for this soaring growth is that energy storage is now being incorporated broadly into utility planning and power system planning across the world, said John Zahurancik, who served as president for AES Energy Storage between 2015 and 2017, and is now chief operating officer of Fluence Energy, a partnership between AES Corp. and Siemens that provides a technology and service package to the power sector. Zahurancik told POWER in January: "If you look at the resource planning guides that are coming out of major utilities, and if you look at the independent system operator areas and the ways that they've incorporated rules changes, they've incorporated energy storage."

SGD&E's 30-MW, 120-MWh system unveiled in February 2017 in Escondido, California, was supplied by AES Energy Storage. The facility was part of an expedited response by the state and the California Public Utilities Commission to the loss of the Aliso Canyon natural gas storage facility north of Los Angeles in 2016. Courtesy: AES Energy Storage

Convergence on the Technology and Industry Fronts

For Kelly Speakes-Backman, CEO of the Energy Storage Association, while the majority of storage today is standalone to support the grid, the value of its ability to convert variable generation into a dispatchable resource cannot be underscored enough. "Four- and five-hour batteries paired with solar plants in Arizona and Hawaii are enabling solar to meet evening demands," she noted. Storage used with conventional generation like nuclear and coal is also showing gains because it transforms them into a more flexible resource, she said. "Most pumped hydro in the U.S. was developed precisely for that reason. And storage paired with mid-merit generation, like gas [combined cycle gas turbines], reduces cycling and enables higher-efficiency generation; that's why you're seeing companies like GE and Wärtsilä pairing batteries with gas-fired generation."

Ghosh noted that the developments are illustrative of two disparate disruptive markers. The first is the convergence of technologies. Falling battery prices make EVs a more viable option, he noted, but they also make solar and other renewables more cost-effective and reliable. The second marker is a convergence of industry. "The solar industry is hedged to the battery industry; the oil industry and the car manufacturing industry is now hedged to the battery industry. And they're all competing for the same supply chain, the same battery production," he said. That interplay is prompting cross-investment, such as by oil companies in renewable facilities. All of it "ultimately means reduction in the cost of these technologies, implying more and more penetration of these technologies going forward."

Changing Consumption Patterns

While those changes play out on the supply side, the demand side has shown a notable shift in power consumption since 2007, spurred in large part by the Energy Independence and Security Act, which mandated lighting standards for 2012, 2014, and 2020. Ghosh noted that a key attribute considered by decision-makers across the power landscape concerns lax demand. Stagnant demand growth has prompted generation project cancellations or fuel source decisions and plays a significant part in resource planning, for example. "The reason you see the impact of energy efficiency now, rather than before, is largely because light bulbs will change every one, two, three years–so the stop turnover is a lot quicker," he said.

Consumption patterns are also being transformed by evolving digital technologies–including technological controls and data analytics–which allow consumers to modify usage. An increasing number of manufacturers and industrial firms are monitoring heating and cooling, or installing energy sensors to gauge consumption variations and predict requirements. Meanwhile, many large manufacturers–Google, Adobe, Procter & Gamble, Walmart, and McDonald's, for example–have announced energy efficiency targets for 2020 to gain a competitive advantage, boost bottom lines, and, more recently, for environmental sustainability.

The Environmental Question

On the flip side, environmental sustainability–the drive for less pollution or decarbonization–could also stimulate demand. "At a very high level, we're going into a world that will use less energy per capita or per [gross domestic product] dollar, and more of the energy consumed will be in the form of electricity," Mark Feasel, vice president of Schneider Electric's Electric Utility Segment and Smart Grid, told POWER in January. In North America–and particularly in California–massive investments have been made for infrastructure to support EVs and port electrification. Outside North America, he noted, rural electrification efforts are also adding new consumers.

Meanwhile, "About 93% of Fortune 500 CEOs have some sustainability metric within their compensation portfolios," Feasel noted. But rather than driven by regulations, sustainability is being fueled by decision making rooted in digitization–which Feasel pointed out is yet another undeniable disruptive factor.

"Data demystifies electricity, which has been historically very difficult to control," he noted. Data is used in myriad ways to boost efficiency and flexibility, as well as to model and customize new technologies for company operations. On a more significant scale, data has allowed resources at the edge of the grid to flourish and allowed for better operation of decentralized energy, another disruptive driver, Feasel added.

The Emergence of the Prosumer

The prevalent growth of distributed energy resources (DERs)–modular or small-scale technologies that empower end users to produce energy locally and time consumption according to the needs of a power system–signifies a "break away from the historic top-down supply structure that has marked electricity systems for more than a century," says the IEA. The most important DER change, it says, has been the growth of rooftop solar photovoltaics (PV), whose global installations grew from 10.7 GW in 2010 to 45.7 GW in 2016 and could soar to 73 GW by 2021. In Australia, for example, more than 20% of households are already equipped with rooftop solar PV, the IEA notes.

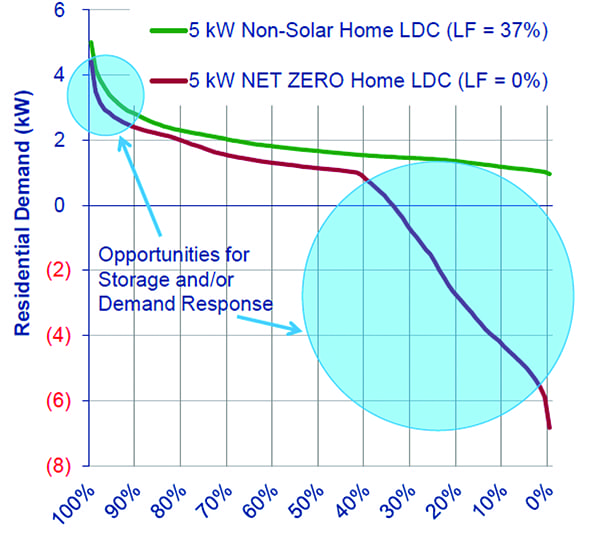

As a whole, DERs–which also include storage, energy efficiency, and demand management–are set to see even weightier growth. The agency says regulatory incentives are driving distribution utilities to weigh traditional upgrades to grid capacity against emerging alternatives. This, in turn, is prompting end users to invest in decentralized generation technologies, transforming them into "prosumers," who actively manage their own production and consumption of energy (Figure 4).

|

| 4. The emergence of the prosumer. The green line shows how a typical consumer in Texas consumes energy. The red line displays the consumption pattern, also known as the low-duration curve (LDC) if a consumer puts a solar panel on their house. Courtesy: Wood Mackenzie |

For Ghosh, the emergence of the prosumer signifies a change to the "whole dynamic of the electricity industry," though he pointed out it is just one of the multiple disruptions the power sector faces today.

When all factors are considered–multiple EVs, rooftop PVs, storage technologies, and digitization–the sector is faced with the challenge of "getting all these technologies to talk to each other on a real-time basis and at the same time maintain reliability," he said.

It remains to be seen how widely these disruptions will play out. For now, changes are coming. As Ghosh concluded: "It's really important to understand these challenges because this is not just about decarbonization, this is about rewriting the whole economy, which obviously, is a very challenging task to do." In 10 more years, perhaps, we can size up their impact with Gordon's "sleeper" scenario. ■

–Sonal Patel is a POWER associate editor.